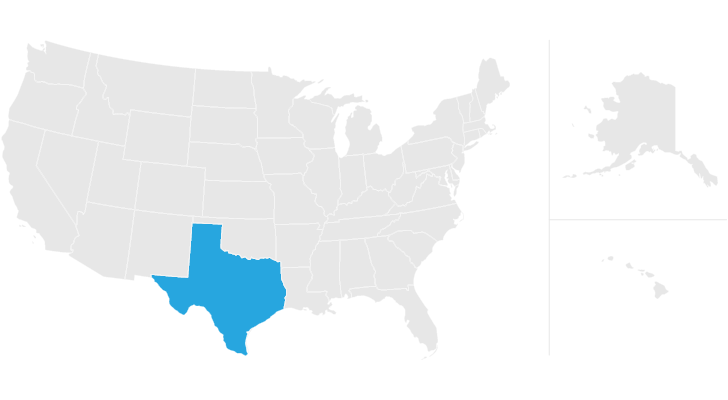

does texas have an inheritance tax in 2020

How to Stop a Solicitor or Bank being the Executor. Alternatively one can take the Medicaid Eligibility Test.

Texas Inheritance Laws What You Should Know Smartasset

First a portion of your tax bill can still rise.

. As a practical matter however very few estates are subject to the federal estate tax. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. 1 online tax filing solution for self-employed.

Based on aggregated sales data for all tax year 2020 TurboTax products. With a fixed income you obviously want to watch that. Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013.

A Except as provided by Subsections f i-1 and k the assessor for each taxing unit shall prepare and mail a tax bill to each person in whose name the property is listed on the tax roll and to the persons authorized agent. It can take anywhere from six to eight months after filing an estate tax return before receiving any type of response from the IRS. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012.

Can a Property be Sold before Probate is Granted. Only those with values in excess of 1158 million are subject to taxation on the balance at the federal level as of 2020. Second you may want to keep the tax.

Are Inheritance Tax Rules Different If Youre Married. Americas 1 tax preparation provider. Estate Funds Distributed to Charities a Probate Case Study.

Not meeting all the criteria does not mean one is ineligible or cannot become eligible for Medicaid. The table below provides a quick reference to allow seniors to determine if they might be immediately eligible for long term care from a Texas Medicaid program. Executor of a Will Duties and Responsibilities.

Inheritance Tax You Only Have 6 Months to Pay. Based upon IRS Sole Proprietor. 1 best-selling tax software.

Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Inheritance And Estate Taxes Ibekwe Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Receiving An Inheritance From Abroad Special Considerations For U S Taxpayers Round Table Wealth

Do I Have To Pay Taxes When I Inherit Money

Is There A Federal Inheritance Tax Legalzoom Com

Estate Planning Attorney Arlington Ma Falco Associates P C Estate Planning Estate Planning Attorney Arlington

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

How To Avoid Estate Taxes With A Trust

Talking Taxes Estate Tax Texas Agriculture Law

3 Reasons Why Almost Every State Except Nebraska Ended Its Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is Inheritance Tax And Who Pays It Credit Karma Tax

Texas Inheritance Laws What You Should Know Smartasset

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney